Enterprise Risk Management

Optimize the effectiveness of your ERM program

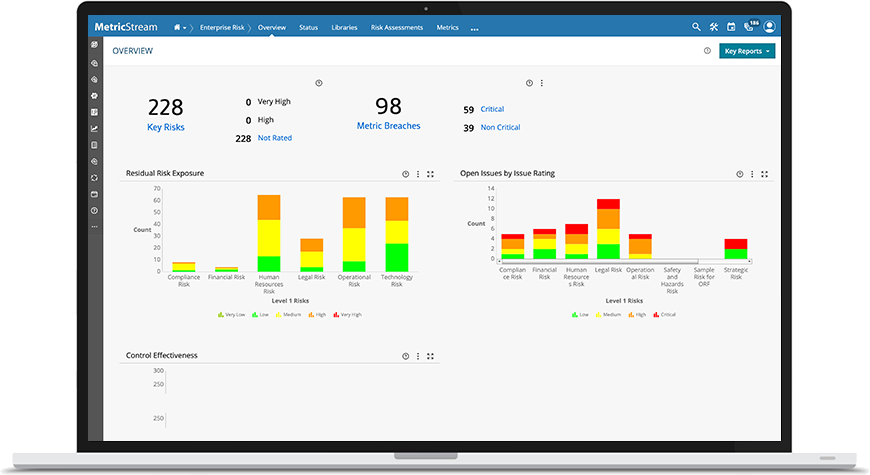

The MetricStream ERM product enables you to identify, assess, quantify, manage, and monitor your enterprise risks, using one unified system.

MetricStream Enterprise Risk Management enables a structured and systematic approach towards managing organizational risks. Built on the M7 Integrated Risk Platform - intelligent by design and supported by uniform risk assessment methodologies and standards, Enterprise Risk Management gives organizations the ability to accurately understand risks and gain clear visibility into the top risks they face. Multi-dimensional risk assessments based on several qualitative and quantitative parameters can be performed to establish the organization’s risk profile.

MetricStream solutions are used by Fortune 500 and Global 1000 customers across industries and geographies to build better governed, more risk-aware, and compliant enterprises.

MetricStream has been recognized by Chartis as ‘Category Winner’ in Audit Management and Enterprise GRC Solution in the 2021 Chartis RiskTech100® Report.

Download ReportDiscover how a leading financial services company overcame the challenges of risk silos, legacy systems, and inconsistent taxonomies to improve risk management maturity and visibility across the three lines of defense.

Read moreIntegrated Risk Solution enables risk-informed decisions that optimize business performance with a cohesive approach.

Learn moreAttend this webinar to understand the crippling effect of a third party or a fourth party breach on your business.

Register NowImprove operational efficiency by reducing the cycle time and costs of risk assessments, while improving resource utilization

Deliver forward-looking risk visibility with predictive risk metrics and indicators that help anticipate and prevent adverse risk incidents

Drive agility and risk-based decision-making by providing a single view of the top risks faced by the organization across the first and second lines of defense

Build confidence with regulators and executive management by establishing a strong risk data governance and issue reporting framework with clear lines of accountability